If you are considering trying to get financing, you have see the term obligations-to-income proportion, tend to abbreviated as the DTI. We’ve amassed information less than to help you know what DTI try and how its determined, along with exactly what it’s popular to own.

What’s Financial obligation-to-Earnings Ratio (DTI)?

DTI is an assessment of your needed monthly financial obligation repayments so you can the monthly terrible (pre-tax) earnings. Potential loan providers tend to consider this to be matter to simply help determine whether or perhaps not they think you can easily pay-off currency you’re asking for so you’re able to acquire from their store.

Exactly how was Personal debt-to-Money Proportion (DTI) calculated?

- First, you place upwards all month-to-month debt burden, such vehicles otherwise college loans and charge card repayments.

- Next, your influence the disgusting month-to-month money. This is the count that you earn before fees was drawn out of your view, not the total amount you in reality buying monthly.

- Once you have these two numbers, your split their complete monthly personal debt money by your monthly terrible income.

- Now proliferate that it address of the one hundred to locate a portion.

Let’s take a look at an example. For this, let’s assume you have got good $250 car payment, a beneficial $400 education loan percentage, the very least fee regarding $a hundred on the playing cards, and you will a month-to-month revenues out-of $dos,five-hundred. Following the tips significantly more than, you can find one to inside circumstance, might has actually a DTI out of 30%.

- Complete month-to-month loans payments: $750

- Month-to-month revenues: $2500

- $750/$2500 = .step three

- .3?100= 30%

When figuring DTI, possible typically only tend to be repeating month-to-month expenses on your own debt total, such as for instance mortgages, auto loans, student loans, minimal costs toward credit cards, and court obligations eg guy support. You normally won’t were different expenditures like a cell phone or electric costs.

When deciding their gross monthly money, it can be as easy as looking at your income report for those who simply have that revenue stream. According to your specific state, yet not, you may need to perform a little more work. You ought to is all sourced elements of money, such as your income, resources, Personal Security, and you will later years earnings.

What is actually DTI Ratio Widely used For?

As mentioned above, DTI is one way you to definitely lenders determine whether you can afford to consider a separate loans. When you have a premier DTI, this may code which you have started excess personal debt and you can could possibly get be unable to build your monthly premiums. When you have a reduced DTI, its more likely you are in a position to afford the loans you thought.

Research shows you to home loan borrowers having a high DTI be more planning to struggle with making the monthly mortgage repayments. Ergo, very lenders put a cover regarding how highest a potential borrower’s DTI would be in order to be accepted to possess a home loan and also to let regulate how much one to mortgage would be.

When obtaining a mortgage, brand new DTI we talked about here is possibly also known as the brand new back-stop proportion. Even better proportion, mortgage lenders and additionally view another kind of DTI your own side-prevent ratio. The front-prevent ratio is the overall in your home-related costs (i.age. financial, property taxes, insurance coverage, HOA fees) separated by the month-to-month gross income.

Do you know the Limitations off DTI?

If you are DTI is helpful obtaining a heart circulation in your financial wellness, you’ll find restrictions in order to they. For-instance, your own DTI does not become month-to-month expenses that are not sensed debt, such as for example cell phone otherwise electric bills, food, an such like. Additionally, DTI just takes into account your earnings in advance of fees, not really what you truly take-home each month.

Because of these constraints, it is essential to maybe not ft the credit decisions only to your their DTI. Prior to taking out even more credit, you need to bring a far more alternative look at the finances and you can consider all expenditures.

Ideas on how to Change your DTI

While wishing to submit an application for a new financing as well as your DTI is high, you will find some methods for you to decrease your DTI.

- Lower existing loans: Consider utilizing the fresh snowball otherwise avalanche method to manage removing debts.

You will need to keep in mind that reducing your DTI doesn’t physically perception your credit rating. Credit scoring bureaus do not know your income, so they really can not estimate your DTI. Although not, because the count you owe is the reason 30% of the credit rating, settling loans will help replace your score.

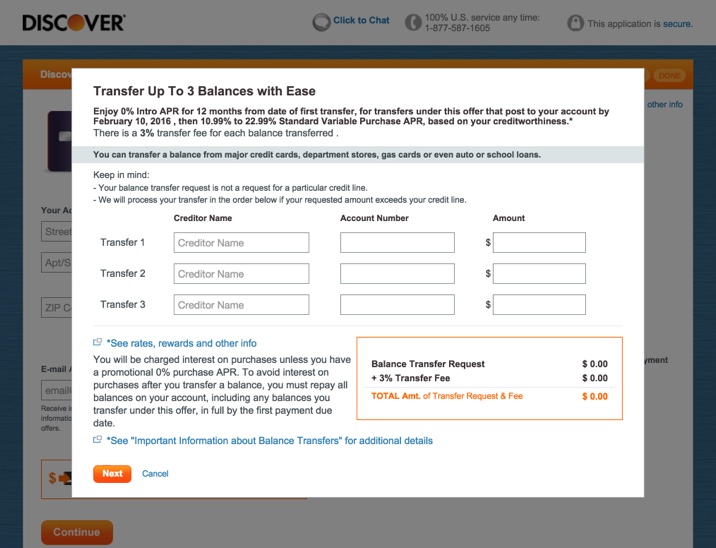

Re-finance Large-Appeal Financial obligation to aid Decrease your DTI and you will Spanish Fort loans Rescue

When you are willing to reduce your DTI, one way to automate your debt benefits agreements is always to get a hold of finance with straight down interest rates. Whether it’s a charge balance import otherwise refinancing a home otherwise auto loan, we provide our very own users aggressive pricing that will help you rescue and you may pay down financial obligation less. Call us today to start off.